How do these tools actually gather data?

Lead intelligence platforms pull information from multiple sources to build a complete, up-to-date picture of your prospects. Common inputs include public records (such as business registrations, press releases, and government filings), web scraping from company websites and professional profiles, and partnerships with trusted third-party data providers.

Some tools rely on static databases, which are compiled and refreshed periodically. While these can be useful for broad market coverage, the data may become outdated quickly, especially if a prospect changes jobs, a company updates its tech stack, or new decision-makers join.

Others use real-time enrichment, where records are updated automatically whenever new information appears online. That approach ensures you’re working with the most accurate details possible, from fresh email addresses to recent funding announcements or organizational changes.

Many modern tools combine both methods: a solid base of verified database entries, supplemented by continuous, automated updates. The blend gives marketing and sales teams the reach of large datasets with the precision of live signals, allowing you to prioritize high-intent leads and personalize outreach with confidence.

Can you integrate lead intelligence with your CRM and outreach tools?

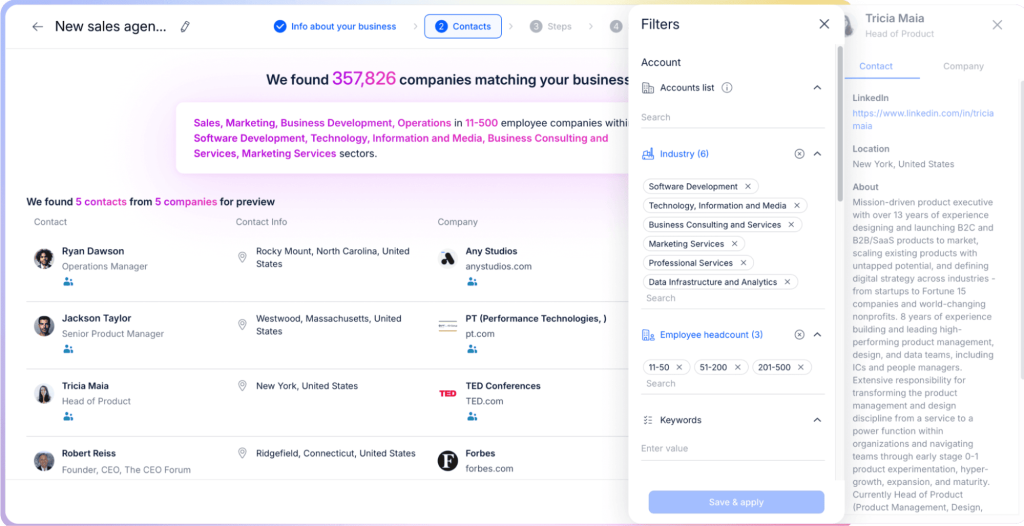

Absolutely. Most lead intelligence platforms offer native integrations with CRMs such as Salesforce, HubSpot, and Pipedrive, along with outreach tools like Reply, Lemlist, and Outreach.io. These connections allow enriched contact details, buying signals, and intent data to flow directly into your existing workflows.

Take Jason AI SDR for example. It automatically pushes in-market prospects and updated contact information into your CRM, ensuring your team always works with the latest job titles, firmographics, and decision-maker details.

When setting up integrations, take time to map your fields correctly so data goes where it should. Regularly clean your CRM by merging duplicates, updating stale entries, and validating contact details. Many tools offer automated enrichment and verification features to help keep records accurate.

A well-integrated lead intelligence platform speeds up outreach and also ensures every interaction is based on the most reliable, up-to-date information available.

How much do these tools cost?

Lead intelligence software spans a wide price range, and the cost depends on how much data you need, how often it’s refreshed, and which features are included. Most tools use one of three models:

- Seat-based pricing: A flat rate per user per month, ideal if your team size is fixed

- Usage-based pricing: You pay for credits, valid emails, or exports. Price is flexible but can rise quickly with large campaigns

- API-based pricing: Billed per API call or record pulled, common for custom workflows or embedding data in your own systems.

Free plans and trials are available for Generect, Lusha, Clay, and LeadIQ, though they generally cap searches, exports, or integrations.

In practical terms, here’s what you get with different budgets:

- $0-$100/month: Entry-level plans like Lusha Pro ($22.45/month) or LeadIQ Pro ($15/month) with small contact limits and basic enrichment

- $100-$500/month: Mid-range tools like Clay Starter ($134/month) or Explorer ($314/month) with more sources, intent data, and automation

- $500-$2,000/month: Advanced, AI-driven platforms with multi-channel outreach and CRM sync. Jason AI SDR sits here, starting at $500/month for 1,000 active contacts and one LinkedIn account, or $1,500/month for 5,000 contacts and five accounts

- $20,000+/year: Enterprise-grade platforms like Bombora ($25k/year), Cognism ($34.5k/year), and 6sense (~$55k/year) with global coverage, predictive scoring, and deep integration into sales and marketing ecosystems

Here’s a quick tip: Match the pricing model to your prospecting volume so you’re not paying for data you won’t use.

Which tool is right for you?

Start by matching the tool to your team’s size, market reach, and main goal.

- Solo founders often get the most value from lightweight, credit-based tools like LeadIQ or Lusha that deliver verified contacts without locking you into big contracts

- Marketing agencies usually need breadth and automation—platforms like Clay or ZoomInfo make sense when you’re handling multiple clients and require large, diverse datasets

- Sales teams benefit from integrated solutions that combine enrichment, scoring, and intent tracking in one place

If you want a platform that goes beyond simply delivering data, Jason AI SDR is worth considering. It doesn’t just find and score leads, it automatically adds them to personalized, multichannel outreach sequences, handles replies, and books meetings, all while syncing with your CRM.

What are common mistakes to avoid?

Even the best lead intelligence software won’t deliver results if it’s used incorrectly. To get the most value, it’s important to avoid a few common mistakes that can derail your efforts.

Paying for more data than your team needs

Many tools price their plans based on the number of contacts, credits, or database access. But if your team only targets a few hundred leads each month, most of that data will go unused. Choose a plan that matches your actual prospecting volume, not the largest database available.

Using outdated or non-compliant data sources

Lead data expires quickly. If your platform pulls from public directories or rarely updates its records, you risk contacting the wrong people. Some tools also skip proper consent, which can create legal risks under GDPR or CCPA. Look for tools that update frequently and include built-in compliance measures.

Choosing tools that don’t integrate with your stack

If the tool doesn’t connect with your CRM or outreach software, your team will spend time copying data manually. That creates delays and increases errors. Make sure the platform integrates with tools like Salesforce, HubSpot, Reply, or Lemlist to keep workflows smooth.

Overlooking buying signals and intent data

Basic lead data isn’t enough. Many teams ignore intent signals such as recent funding, website activity, or tech adoption. These insights help you prioritize leads who are more likely to convert.

Final thoughts: Is lead intelligence worth it?

In 2025, being late to a prospect’s buying journey is the fastest way to lose the deal, and you rarely get a second shot.

Lead intelligence pays for itself the moment it helps you win an account you would have otherwise missed. The gains show up in shorter sales cycles, higher close rates, and conversations that feel tailored, not templated.

If your outreach often feels like guesswork, you’re leaving revenue on the table. The right platform gives you precise timing, richer context, and a clear path to the decision-makers who matter most.

That’s exactly where Jason AI SDR comes in. It spots in-market prospects the moment they show intent, enriches their data automatically, and moves them into tailored outreach sequences automatically. Instead of chasing cold leads, you’ll be first in line with the right message at the right time. Book a demo today and see how Jason can fill your pipeline with qualified prospects.

FAQs

What is lead intelligence software?

Lead intelligence software gathers and analyzes data about your prospects to help you identify which leads are most likely to convert. It combines contact info (like email and job title) with behavioral and contextual insights, such as recent funding, tech stack changes, hiring trends, or content engagement.

It helps sales and marketing teams go beyond cold lists. Instead of reaching out blindly, reps can prioritize leads showing buying intent, personalize their outreach, and time their follow-ups based on real signals, not guesswork.

Lead data tells you who the lead is. Lead insight tells you why they might be ready to talk.

What is the best lead intelligence software?

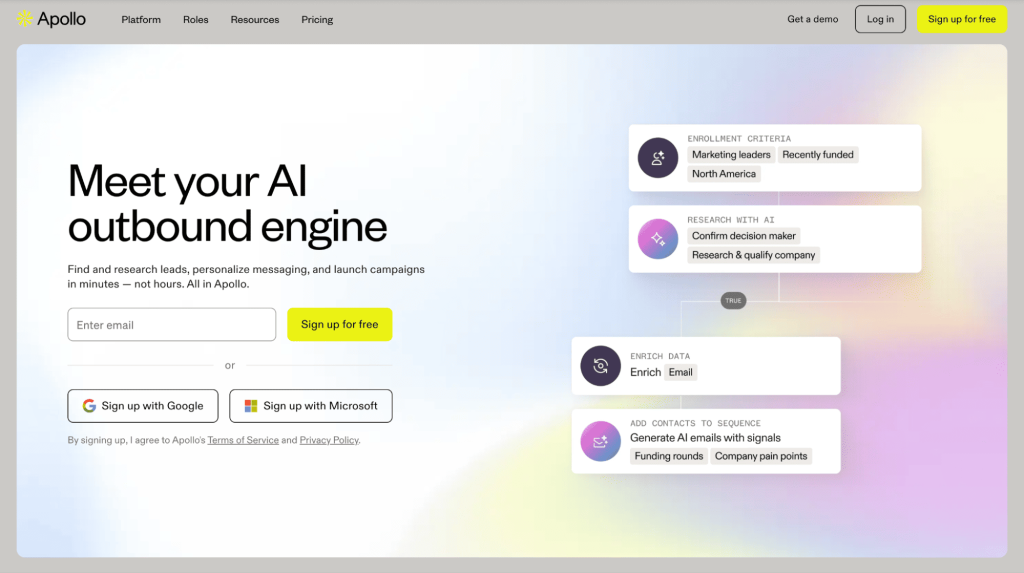

The best lead intelligence software in 2025 is one that fits your market, scales with your team, and turns customer data into action. Leading lead intelligence solutions like Jason AI SDR, Clay, ZoomInfo, Lusha, and 6sense combine sales intelligence tools with real-time intent tracking, enrichment, and AI scoring.

The key is data accuracy—without it, your outreach risks being late or irrelevant. The right platform should give you actionable insights for data-driven decision making, helping you focus on the prospects most likely to convert instead of wasting time on cold leads.

Does Jason AI SDR support CRM integration?

Yes. Jason AI SDR integrates directly with major customer relationship management platforms like Salesforce, HubSpot, and Pipedrive. The connection ensures your enriched customer data syncs automatically, keeping records fresh and maintaining data accuracy.

With CRM integration, Jason goes beyond being a sales intelligence tool; it becomes a central part of your prospecting workflow, making way for data-driven decision making and helping your team move faster on high-intent opportunities.